Will UKIP make me Richer, or will UKIP make me Poorer?

by thedirtyho

There seems to be this idea that UKIP are the only party representing the working class, so I’ve come up with a fun game called “Will UKIP make me Richer, or will UKIP make me Poorer”.

Anyone can play, all you need is a pen, some paper, a calculator and your annual salary before Tax and National Insurance. (For those that like to cheat, or can’t be bothered, the answers are at the bottom).

Here’s what you do:

Firstly, work out how much National Insurance you pay.

Divide your annual salary by 52 to work out what you earn per week.

If this is higher than £153 and less than £805, subtract 153 and multiply this by 0.12.

Anything over £805, subtract 805 and multiply by 0.02. Add this 2% figure to the 12% figure.

Now multiply this by 52. This is how much National Insurance you pay per year, keep hold of this number.

Now for the tax. If you earn less than £10k you won’t pay any. Anything between £10k and £31,865 you pay 20%, so if you earn between these two amounts subtract £10k and multiply by 0.2.

If you earn over £31,865 then you’ll pay 20% on £21,865 (£4,373).

For the higher rate 40% tax subtract 31,865 from your annual salary and then multiply this by 0.4. Add this to your 20% rate of £4,373.

This is the amount of Income Tax you pay per year. Make a note of this as well.

If you earn over £100k it’s different, but if that’s the case, take my word for it – you’re winning.

Now add the amount of Income Tax you pay to the amount of National Insurance to work out your total contributions. Then subtract this from your annual salary before tax & NI.

This is how much you earn under the 2014/15 tax rules.

You can check these at http://www.hmrc.gov.uk/rates/it.htm and athttp://www.hmrc.gov.uk/rates/nic.htm

Now to work out what you would earn under UKIP:

Take your annual salary and multiply by 0.69.

This is how much you earn under UKIP.

So – will UKIP make you Richer? Or will UKIP make you Poorer? Are you a UKIP winner? Or a UKIP loser?

Here’s the answers for the cheats:

Basically, if you earn under £50k a year, you’ll be worse off.

If you earn £15k, you’ll lose about £2800 a year.

If you earn £20k, you’ll lose £2750.

If you earn £25k, you’ll lose £2700.

If you earn £30k, you’ll lose £2650.

If you earn £35k, you’ll lose about £2000.

If you earn £40k, you’ll lose about £900.

If you earn £45k, you’ll lose £250.

And finally if you earn £50k you’ll gain £200 per year.

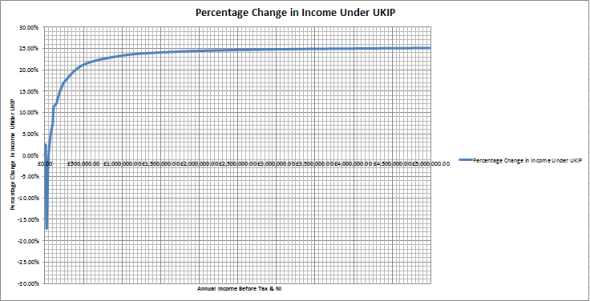

This means the lowest earners will be losing more than 15% of their income under UKIP. To benefit from them you have to earn at least £50,000 a year.

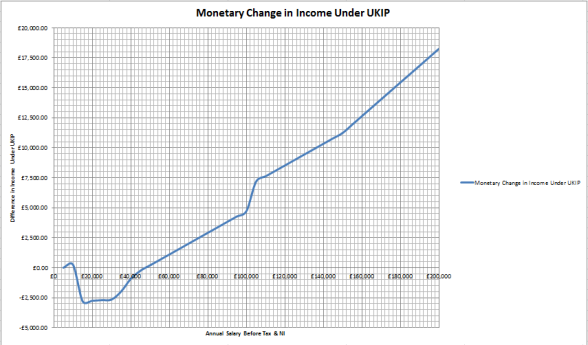

By comparison, someone earning £100k a year sees their income increase by £4700, or 7%.

Someone earning £200k gets an £18,250 increase, or 15% more.

Someone earning £250k a year gets £25k a year extra, or a 17% increase.

Someone earning £500k gets £60k more, or a 21% increase.

Someone earning £1M gets £130k more, an increase of 23%.

Someone earning £5M a year gets £690k more, an increase of a shade over 25%.

So – do UKIP represent the working class, or are they simply ensuring the rich get richer?

Have a look at the graphs underneath and decide for yourself.

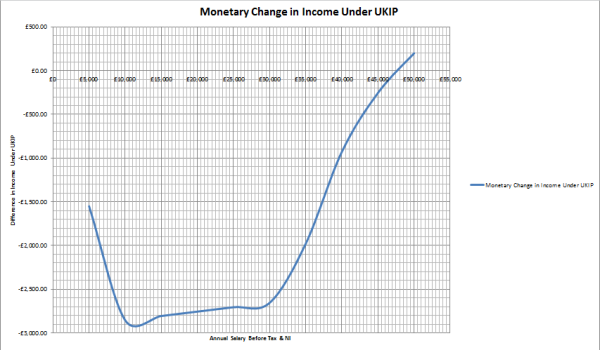

This is how much money you’d take home under 2014/15 tax rules and under UKIP’s 31% flat tax, up to an annual salary of £50,000.

This is how much worse off/better off you’d be under UKIP, up to an annual salary of £50,000.

This is how much worse off/better off you’d be under UKIP, up to an annual salary of £200,000.

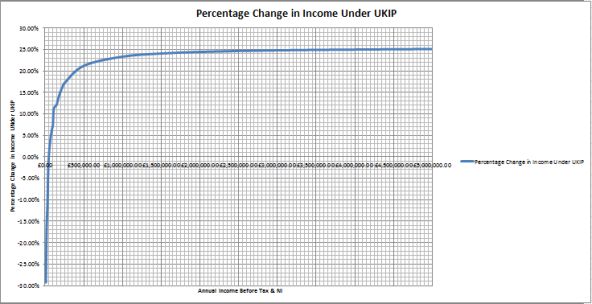

This is how much your income would change as a percentage under UKIP, up to an annual salary of £50,000.

This is how much your income would change as a percentage under UKIP, up to an annual salary of £200,000.

This is how much your income would change as a percentage under UKIP, up to an annual salary of £5,000,000.

So – a 10% or greater loss for anyone earning £30,000 or less, and a 10% or greater increase for anyone earning over £105,000. Anyone earning more than £500,000 a year sees a greater than 20% increase in their income.

EDIT:

It has come to my attention that I may have slightly misrepresented UKIP’s policy on tax.

The flat tax policy set out in their manifesto is one of a raft of policies that has now been disowned, and replaced by . . . well, nothing actually. On their issues page UKIP say they will remove tax on the minimum wage and scrap inheritance tax, but have no policy on Income Tax and National Insurance.

It seems that whilst their original policy advocated scrapping the £10,000 personal allowance, this was replaced by zero tax on anyone earning below £11,500, but a flat tax of 31% on anyone earning above that.

The upshot of this is that someone earning just £10k will be about £250 better off, someone earning £11k will be about £560 better off, and someone earning £12k will be again, around £2800 worse off. For anyone between £11.5k and £50k a year, a 31% flat tax would result in a loss of income.

To reflect this, I have recalculated, the results of which can be seen below:

I didn’t have time to read the rest of the post, but i wanted to mention that the assumption that you pay higher rate tax on income over £31,865 is incorrect. It’s actually on income over £41,865 (for most people) – the £0 – £31,865 refers to the size of the basic rate *band*, not the absolute income level.

Hi, thanks for the comment. I checked this with an ex-HMRC employee, and they said that the 20% band is based upon the absolute income level of £31,865. Obviously this throws up conflicting information, but for now – in the absence of further evidence – I’m gonna stick with treating it as such.

Boredaccountant is correct, sorry. See http://listentotaxman.com/ for a calculator and a summary of the rules for humans.

This analysis seems to disregard any change in the personal allowance.

“This page suggests “the main thrust will be flat tax with high thresholds” with the general idea being a personal allowance of around £13,000 (transferable between spouses) and a flat rate about 25%”

http://www.accountingweb.co.uk/blog-post/ukip-s-tax-policies

In 2013, UKIP were advocating a £13k personal allowance (transferable between spouses), when the prevailing (non-transferable) allowance was £8105 (2012/2013) or £9440.

That probably won’t change the shape of the graph too much, even if UKIP raised the personal allowance significantly above the current threshold of £10000, but it seems to be a slightly unfair comparison.

From what I’ve seen, it appears there wasn’t a personal allowance as such (where nobody pays tax on a certain section of their income) but rather no obligation for those earning under £11.5k to pay any income tax, and a blanket 31% flat tax for all those earning over £11.5k.

Happy to amend if any additional information comes my way, but I’ve adjusted and edited to suit

http://www.ukip.org/issues includes the text:

“No tax on the minimum wage.”

You’ve already had it confirmed by Tim Worstall on Twitter that that translates to a ~£13k personal allowance (i.e. tax free) that is transferable between spouses (unlike the current non-transferable, for earnings anyway). Tim wrote most (all?) of UKIP’s tax policy (such as it stands anyway; you’re right to identify that it’s difficult for anyone to be sure of what UKIP’s policies are right now, but as that’s the case, why the attack on something that they may not stand for any longer?)

I’ll also take back the last paragraph of my written-too-quickly earlier post; the £13k allowance extends the 1:1 gradient of the current system upto £13k, then proceeds at pretty much the same gradient as the current system. So it won’t result in more income tax being taken from anyone, but a tax cut for everyone instead, and an even larger tax cut for people with incomes over £55k-odd.

You appear to have missed the threshold on UKIPs tax proposal, no tax is paid on income below, IIRC, £12,500 p/a (worked out at minimum wage full time). Which makes most of the rest of your maths wrong.

I’m all for attacking UKIP on their stupid policies, and I’m all for a serious debate on flat taxes, thresholds, etc, but to attack them for a policy they don’t have would be damaging if any of their senior reps had the gumption to know what their policy actually was.

I’ve edited to suit, as I agree with what you’re saying. I have actually asked UKIP and Nigel Farage what their tax policy is now, but neither responded . . .